Early retirement is an enticing goal for many, and leveraging dividend stocks can be a key strategy in achieving this dream. As of 2024, the appeal of dividend stocks remains strong, particularly in the face of market volatility.

Historically, dividends have contributed significantly to the total returns of investments, with some research indicating they account for up to 85% of the cumulative total return of the S&P 500 index since 1960. This makes dividend stocks a powerful tool for generating steady income, which is pivotal when planning for an income stream during retirement.

Dividend yields can vary greatly depending on the stock, with some of the top performers in 2024 offering yields as high as 21%. These stocks span various sectors, including transportation, energy, and investment trusts, ensuring that investors can find opportunities that align with their risk tolerance and income needs.

When you carefully select dividend stocks with strong fundamentals, a sustainable dividend yield, and a strong payout ratio, investors can build a portfolio that not only supports their retirement but also grows with them over time.

Getting Into Dividend Stocks: A Pathway To Financial Stability

Investing in dividend stocks is an attractive strategy for those looking to build a stable income stream, particularly for individuals planning for retirement or seeking financial independence.

Dividend stocks provide regular payouts, making them a reliable option for generating consistent cash flow.

We’ll go through the process of getting started with dividend stocks, with a focus on finding monthly dividend stock lists, evaluating potential investments, and building a diversified portfolio.

Finding A Monthly Dividend Stock List

One of the first steps in getting started with dividend stocks is to identify which stocks pay dividends monthly.

Monthly dividend stocks are particularly beneficial because they provide a steady income stream, aligning well with personal budgeting needs. To find a well rounded list of these stocks, websites like Sure Dividend are an invaluable resource.

Sure Dividend offers a regularly updated list of monthly dividend stocks, featuring companies that provide yields as high as 17.9%. This list is a great starting point for investors because it ranks stocks based on their dividend yield and financial stability, helping you identify potential investments that align with your financial goals.

Evaluating Potential Dividend Stocks

Once you have a list of potential monthly dividend stocks, the next step is to evaluate them based on several key factors.

- Dividend Yield And Payout Ratio: A high dividend yield might seem attractive, but it’s important to ensure that the payout is sustainable. The payout ratio, which is the percentage of earnings paid out as dividends, provides insight into whether a company can maintain its dividend payments over time. A lower payout ratio generally indicates that the company is reinvesting earnings into growth, which can lead to future dividend increases.

- Financial Health: Look into the company’s financial stability by examining its earnings reports, debt levels, and overall profitability. Companies with strong cash flows and low debt are more likely to sustain and grow their dividends. Resources like Simply Safe Dividends provide safety scores that can help you gauge the risk associated with a company’s dividend payments.

- Sector And Industry: Consider the sector and industry of the stock. Certain sectors, like utilities and consumer staples, are known for their stable dividends due to the essential nature of their services. Diversifying your investments across various sectors can reduce risk and ensure that your income stream is not overly dependent on one particular industry.

Building A Diversified Dividend Portfolio

Building a diversified portfolio is key to mitigating risk and maximizing returns. Here are some strategies to consider:

- Diversification Across Sectors: By investing in dividend stocks from different sectors, you can protect your portfolio from industry-specific downturns. For instance, combining investments in utilities, healthcare, and real estate can provide a balance of stability and growth.

- Including International Dividend Stocks: Don’t limit yourself to domestic stocks. International dividend stocks can offer exposure to different economic environments and additional opportunities for growth. However, be mindful of currency risks and foreign tax implications.

- Reinvesting Dividends: Consider reinvesting your dividends into additional shares of stock. This strategy, known as dividend reinvestment, can compound your returns over time, especially if you’re not yet relying on the income for living expenses.

Funding Your Early Retirement With Monthly Dividend Stocks

Transitioning to early retirement requires a well-structured financial strategy, and leveraging monthly dividend stocks can be an effective way to ensure a stable income stream.

Monthly dividends offer consistent cash flow, which is particularly beneficial for managing regular expenses in retirement. Let’s have a look at how you can strategically use monthly dividend stocks to fund your early retirement.

Building A Diversified Monthly Dividend Portfolio

Creating a diversified portfolio is the cornerstone of using monthly dividend stocks to fund your retirement. The goal is to ensure that your income is stable and grows over time, reducing the risk of relying on a few sources.

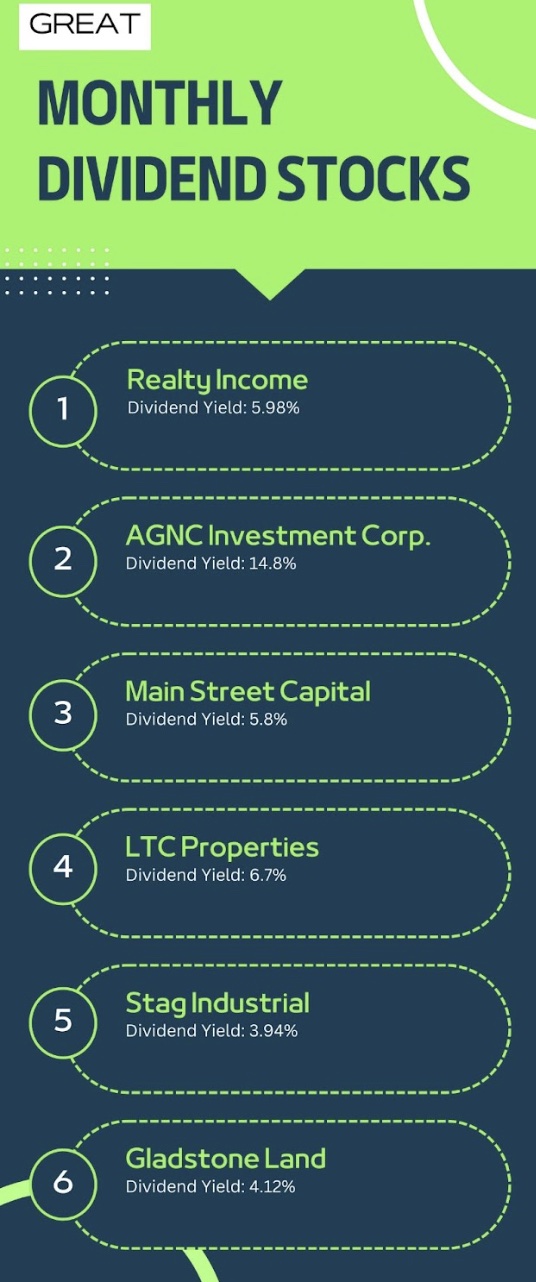

- Selection Of Stocks: Focus on high-quality companies known for their reliability in paying dividends. Companies like Realty Income (O), known as “The Monthly Dividend Company,” are prime examples. These firms not only provide regular dividends but also have a history of increasing payouts, which helps combat inflation over time.

- Diversification Across Sectors: Avoid over-concentration in a single sector. For example, you might want to spread your investments across real estate investment trusts (REITs), utilities, and consumer staples, each known for stable dividends. By doing this, you can protect your income from sector-specific downturns. A balanced portfolio might include a mix of Dividend Aristocrats, which are companies that have increased their dividends annually for over 25 years, providing both stability and growth.

- Reinvesting Dividends: During the early phases of building your portfolio, consider reinvesting your dividends to purchase additional shares. This strategy, known as a Dividend Reinvestment Plan (DRIP), can significantly increase your holdings over time, compounding your returns and boosting your income when you eventually start drawing on it for living expenses.

Calculating The Required Investment

Understanding how much you need to invest is paramount. The amount depends on your income needs and the average yield of your selected dividend stocks.

- Yield Calculations: If your goal is to receive $3,000 per month in dividends, and your portfolio has an average yield of 4%, you would need an investment of approximately $900,000. This calculation is straightforward: divide your desired annual income by the portfolio’s yield (e.g., $36,000 / 0.04).

- Starting Small: If this seems daunting, start with a smaller investment and gradually increase it. For instance, investing $100,000 at a 4% yield would provide $333 monthly, which you can reinvest until your portfolio reaches the desired size.

Managing And Adjusting Your Portfolio

As you approach retirement, it’s necessary to regularly review and adjust your portfolio to ensure it continues to meet your income needs.

- Regular Portfolio Review: Monitor your stocks to ensure they continue to perform well. Adjustments may be necessary if a company cuts its dividend or if better opportunities arise. Various sites offer detailed analyses and updates on dividend stocks, which can be helpful in making informed decisions.

- Tax Considerations: Keep in mind the tax implications of your dividends, especially if your investments are held in taxable accounts. In many cases, qualified dividends are taxed at a lower rate than ordinary income, but this can vary based on your overall tax situation.

- Market Adaptation: Be prepared to adapt to market changes. Economic downturns may affect dividend payouts, so having a mix of stocks with different risk profiles can help stabilize your income.

Wrapping Up

Using dividend stocks to fund early retirement is a dynamic and powerful strategy, but it requires careful planning and ongoing management. Beyond the strategies discussed, it’s important to stay informed about market trends and continuously educate yourself about new opportunities in dividend investing.

As the economic landscape evolves, so too should your investment approach, ensuring that your portfolio remains resilient and aligned with your long-term retirement goals.

If you stay flexible and proactive, you can effectively navigate the complexities of early retirement funding.